TUESDAY, MAY 26, 2015

Rick Mikolasek December 20, 2010 as published on The Truth About Insurance website

http://www.thetruthaboutinsurance.com/new-car-replacement-insurance-vs-gap-insurance/

Insurance match-ups: “New car replacement vs. gap insurance.”

First off, congratulations on the purchase of your new car. Now let’s make sure you have the right insurance to cover your new baby.

You’ve likely heard that a new car loses value the second it’s driven it off the lot. Well, the reality is the car probably loses value the minute you sign the paperwork.

Either way, if you get into an accident shortly after you purchase the car, you could be subject to owing more money to the bank than the car is worth, assuming you took out a loan or a lease.

Here’s How it Can Go Wrong

You purchase a car with no or little money down for $25,000. Within the first year, a car can lose as much as 20% of its value. In other words, your $25,000 car might be worth as little as $20,000 within the first year. If your car is totaled during that first year, you may still owe as much as say $23,000. The bank that lent you the money to purchase the car is not going to “forgive” the difference between what you owe and what the car is worth, which is referred to as its actual cash value (figured as the replacement cost new, minus the depreciated value).

What Are Your Options?

Insurers and lenders have designed two options for this relatively common occurrence. You can either purchase “new car replacement insurance” or “gap insurance,” which is also referred to as “loan/lease” coverage. Let’s look at the difference between the two:

New Car Replacement Insurance

New car replacement insurance is the better (and more expensive) of the two options. This option is typically only available for the first year of car ownership, as it wouldn’t make sense for an insurance company to replace your car after that time due to the rapid loss of value it will experience. New car replacement insurance may differ by company, but you can expect your coverage to include the following:

1. Your insurer will pay the verifiable new vehicle purchase price of your damaged vehicle, not including any insurance or warranties purchased; or

2. The purchase price, as negotiated by the insurer, of a new vehicle of the same or similar make, model and equipment, not including any furnishings, parts or equipment not installed by the manufacturer or manufacturer’s dealership; or

3. The market value of your damaged vehicle, not including any furnishings, parts or equipment not installed by the manufacturer or manufacturer’s dealership. So your aftermarket rims and stereo are not covered here.

This coverage is provided without deduction for depreciation. That’s really the key here. You don’t have to worry about losing money thanks to any value your car lost, i.e. you are not on the hook for the difference between what the car is worth and what you owe…you just get a new car!

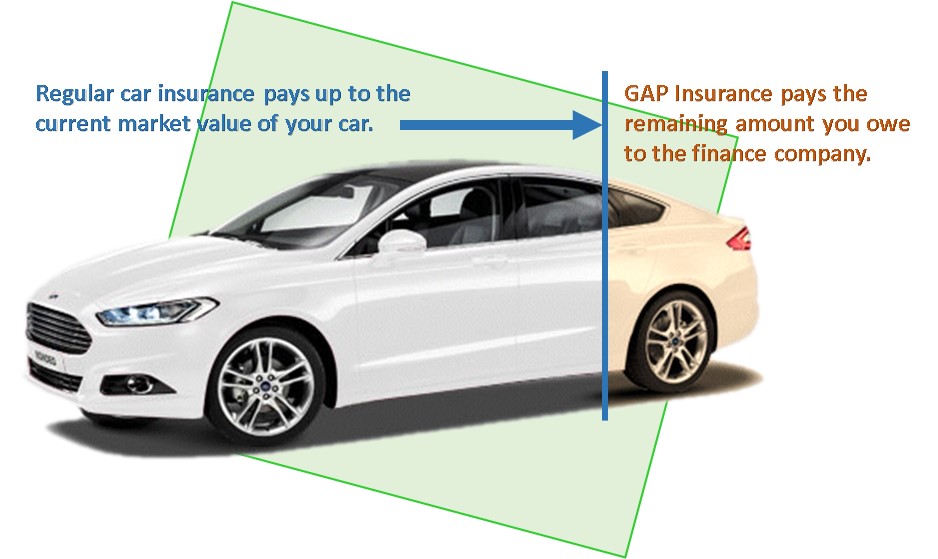

Gap Insurance (Loan/Lease Coverage)

Gap insurance, on the other hand, is designed to pay only the difference between what your car is worth and what you owe. You can forget about getting a new car. As your car gets a little older, this may be the only coverage available. The older the car, the more the value depreciates. It wouldn’t make sense for the insurance company to go around and buy a new car for everyone who suffered a total loss on their car after it had lost half its value!

Gap coverage may vary depending on which insurer or lender you purchase from, but you can expect to receive benefits similar to those outlined below. You can expect to receive the difference between what you owe and what the car is worth minus the following, which aren’t covered:

1. Any overdue loan/lease payments at the time of loss.

2. The insurer/lender will not cover financial penalties imposed under a lease for excessive use, abnormal wear and tear or high mileage…NO FREEBIES!

3. Security deposits not refunded by a lessor. Basically, if you made a security deposit, you are not getting it back.

4. You will also not receive any money for the cost for extended warranties, Credit, Life Insurance, Health, Accident or Disability insurance purchased with the loan or lease. This means that any of the extra bells and whistles you were talked into buying when you were experiencing the euphoria of your new car purchase are not going to be reimbursed.

5. You shouldn’t expect to receive any compensation for carry-over balances from previous loans or leases. Previous poor financial decisions are not covered here.

Be smart with your new purchase. Obtain coverage that will ensure you do not end up owing money on a vehicle you no longer own.

Both new car replacement insurance and gap coverage are relatively cheap…we are talking about $5 extra dollars per month or less.

So be sure to contact your insurance company or independent agent today for details!

1 Comments

cash for cars sydney said...

Hello!

We made the most of the content you shared on your site, it was very informative and great. Your site was introduced to me by a friend of mine. Sometimes I visit your site. I enjoy seeing your content. I introduced your site to some of my friends.

Good luck shining like always.

If you are looking for information about different types of used and old cars, click on the link below.

https://cash-cars.sydney/

SATURDAY, FEBRUARY 20 2021 9:56 AM

Post a Comment |

|

Required

|

|

Required (Not Displayed)

|

|

Required

|

All comments are moderated and stripped of HTML.

|

|

|

|

|

|

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|

Blog Archive

|